san antonio property tax rate 2019

Property Tax Per Capita 2019 PropertyTax per Capitaxlsx. Bexar County lowered its tax rate last year to 304097 cents.

San Antonio Could Roll Back Its City Property Tax Rate Due To Higher Projected Revenues Tpr

Thereafter interest will continue to be added at the rate of 1 per month until the tax is paid.

. Instead it has been property values that have driven the incessant increases to. Multiply that by 240000 and you come up with a tax bill of 569617 per year. However when compared against many other southern states the property taxes found in San Antonio are actually quite high.

Hours Monday - Friday 745 am - 430 pm. San Antonio River Authority. Comptroller of the Treasury Jason E.

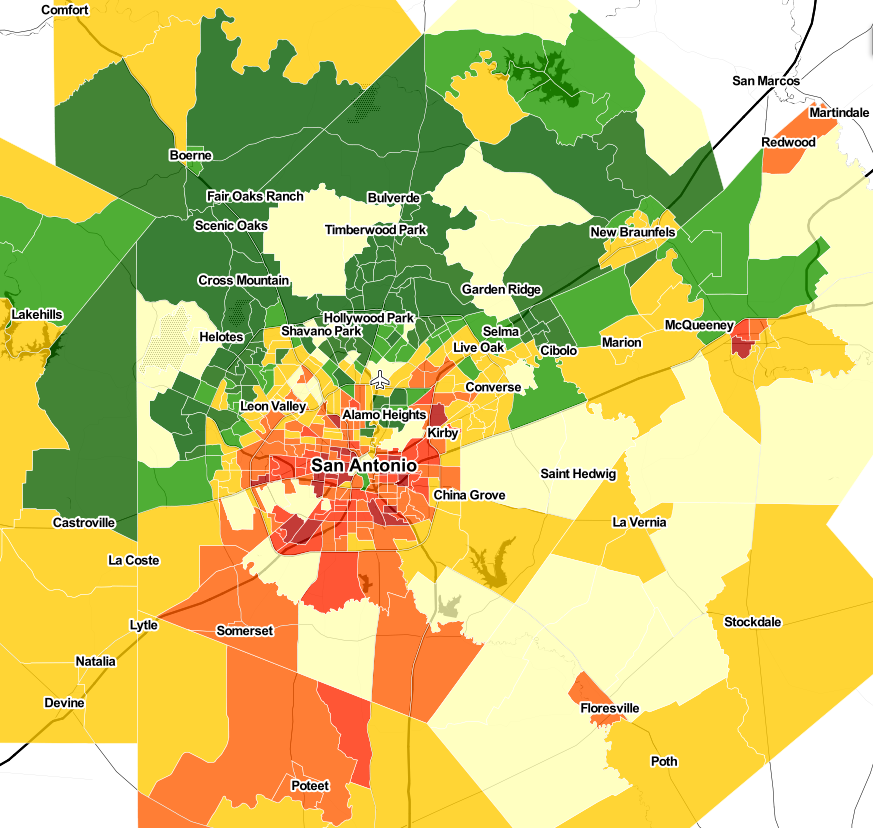

The effective tax rate for the city of San Antonio this year is 54266 cents per 100 valuation. China Grove which has a combined total rate of 172 percent has the lowest property tax rate in the San Antonio area and Poteet with a combined total rate of 322 percent has the highest rate in the area. San Antonio was the last major Texas city to implement a homestead exemption.

City of San Antonio. City of San Antonio Property Taxes are billed and collected. Setting tax rates appraising property worth and then receiving the tax.

Herein how much are taxes in San Antonio. City of San Antonio Print Mail Center Attn. Sheridan San Antonio Texas 78204.

Greg Abbott signed the new law Senate Bill 2 in 2019 and it took effect in 2021 when the citys property tax revenues increased by 31. PersonDepartment 100 W. Property taxes for debt repayment are set at 21150 cents per 100 of taxable value.

Ad Unsure Of The Value Of Your Property. City of San Antonio Attn. The City Council approved a 001 exemption of your homes value.

City of Alamo Heights. On the lower spectrum of tax rates when it comes to incorporated cities Selmas total property tax rate is 237 per hundred dollars. The Official Tax Rate.

Mumpower State Capitol Nashville TN 37243-9034 6157412775 To Report Fraud Waste Abuse. Catahoula County in Louisiana has a tax rate that is only 02 while Iberville County in Louisiana has a tax rate of only 21. It may seem like a.

Digital Flood Insurance Rate Map. Only property taxes levied on existing properties not new developments count toward the. Property tax rates in Texas are recalculated each year after appraisers have evaluated all the property in the county.

The average homeowner in Bexar County pays 2721 annually in property taxes. San antonio property tax rate 2019 Sunday June 12 2022 Each tax year local government officials such as City Council Members School Board Members and Commissioners Court examine the taxing units needs for operating budgets and debt repayment in relation to the total taxable value of properties located in the jurisdiction. San Antonio TX 78205.

The citys revenues for 2022 is 21. The minimum combined 2020 sales tax rate for San Antonio Texas is 825. Thats nearly 13 lower than San Antonios total property tax rate.

This is the total of state. Bexar County collects on average 212 of a propertys assessed fair market value as property tax. Overall there are three phases to real estate taxation namely.

2019 Official Tax Rates. The following table provides 2017 the most common total combined property tax rates for 46 San Antonio area cities and towns. For 2018 officials have set the tax rate at 34677 cents per 100 of taxable value for maintenance and operations.

Each unit then is given the tax it levied. In San Antonio. Find All The Record Information You Need Here.

The tax rate in nearby in Louisiana are much lower for example. The potential property tax reduction. PersonDepartment PO Box 839966 San Antonio TX 78283-3966.

Example - Penalty and interest will be added at a rate of 7 for February 2 per month for March through June and 3 for July. Local News San Antonio Property Tax Rate to Hold Steady in 2019 Budget By 1200 WOAI Aug 3 2018 1200 WOAI Aug 3 2018. Property Tax Per Capita 2019.

The median property tax in Bexar County Texas is 2484 per year for a home worth the median value of 117100. City officials have said they would rather avoid such an election. 48 rows Find the local property tax rates for San Antonio area cities towns school districts and Texas counties.

Alternatively the city could exceed the revenue cap but doing so would trigger an election asking voters permission to keep the additional tax revenue per the new law. Alamo Community College District. Property Tax Per Capita 2019.

If there is a decrease in the citys property tax rate currently set at 558 cents per 100 of property value it would take effect in January next year. Wed 07312019 - 1445. Submit a report online here or call the toll-free hotline at 18002325454.

Road and Flood Control Fund. Homestead tax exemptions 100 disabled veterans. Bexar County has one of the highest median property taxes in the United States and is ranked 282nd of the 3143 counties in order of.

Its currently set at 556 cents per 100 of valuation and brings in 30 percent of the citys general fund revenue. The citys current tax rate which accounts for about 22 of property tax bills is nearly 056. In San Antonio the countys largest city and the second largest city in the entire state the tax rate is 238.

Mailing Address The Citys PO. The Official Tax Rate Each tax year local government officials such as City Council Members School Board Members and Commissioners Court examine the taxing units needs for operating budgets and debt repayment in relation to the total taxable value of properties located in the jurisdiction. They are calculated based on the total property value and total revenue need.

Box is strongly encouraged for all incoming mail. Property Tax Rate Calculation Worksheets by Jurisdiction. Get Record Information From 2021 About Any County Property.

Taxing entities include San Antonio county governments and a number of special districts such as public hospitals.

Sa May Be Forced To Cut Property Tax Rate Council Also Considering Raising Homestead Exemption

All Of Us Are At A Breaking Point San Antonio Bexar County Leaders Look To Austin For Property Tax Relief

Which Texas Mega City Has Adopted The Highest Property Tax Rate

Want A Break On Property Taxes These San Antonio Communities May Keep More Money In Your Pocket

What Is Affordable Housing In San Antonio City Council To Consider Adopting This Definition San Antonio Heron

Appraisal Animosity Fuels Push To Increase Homestead Exemptions In San Antonio Tpr

San Antonio Real Estate Market Stats Trends For 2022

Bexar County Commissioners Approve 20 Homestead Exemption

2119 Sacramento San Antonio Tx 78201 Mls 1603051 Zillow

Relocating To San Antonio Here S What You Need To Know

6765 Ralston Beach Circle Mortgage Mortgage Calculator Beautiful Homes

Appraisal Animosity Fuels Push To Increase Homestead Exemptions In San Antonio Tpr

Want A Break On Property Taxes These San Antonio Communities May Keep More Money In Your Pocket

San Antonio Property Tax Rate Cut Homestead Exemption Increase Mulled

San Antonio Real Estate Market Stats Trends For 2022

Hotel Grand Hyatt San Antonio River Walk Usa Booking Com

San Antonio Trip Planner A Guide To San Antonio

San Antonio Property Tax Rate Cut Homestead Exemption Increase Mulled